Philippe Piscol, Managing Partner at enomyc, has successfully been driving the field of distressed M&A for 8 years with great energy. What has he come to expect: Will the number of insolvencies continue to rise? Will the complexity of cases increase? Is it worth investing now? The interview also deals with the main topics involved in distressed M&A: How do you achieve a smooth sales process? What is important in the network and last but not least, what is it that attracts him personally to distressed M&A?

Mr. Piscol, you are an expert in distressed M&A. Do you have the impression that the number of cases has increased in recent years?

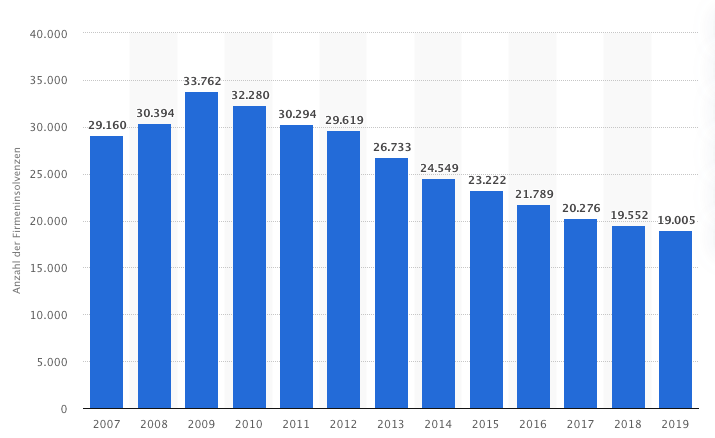

Over the last 8 years we have seen a continuous increase in demand. And this is contrary to the trend, because if you look at the market as a whole and the statistics, you can clearly see that bankruptcies have fallen sharply in recent years. However, through the COVID-19 pandemic, distressed M&A is experiencing a kind of renaissance.

Anzahl der Firmeninsolvenzen in Deutschland von 2007 bis 2019. Quelle: Statista.

Anzahl der Firmeninsolvenzen in Deutschland von 2007 bis 2019. Quelle: Statista.

Have you also gained the impression in recent years that insolvencies are becoming increasingly complex? And if so, what are some of the reasons for this?

I do not believe that the insolvency cases themselves have become more complex. What is becoming more common though, is that insolvency cases involve proceedings that are conducted while still under the company's own management. For us as a service provider in distressed M&A branch, these self-administered proceedings represent an increased complexity, because in addition to the best possible satisfaction of creditors, the preservation of the old company is a further objective. Here, we perform the balancing act between a clean dual-track process and the decisive goal of preserving the company for the former shareholder(s).

Another additional layer of complexity that we believe is growing is that transactions are becoming increasingly international. We are increasingly working with Asian investor groups, primarily from China. Here, the issue of transferring capital to Europe is a problem. In some cases, cultural differences, and language barriers also complicate negotiations. More and more groups of financial investors specializing in distressed M&A are emerging. When they buy a company out of insolvency, they often pursue a buy-and-build strategy, i.e. they buy companies to gain greater importance in an established market segment.

Who are typically the key players involved in a distressed M&A process?

In classic insolvency proceedings, the insolvent company itself- in regular proceedings represented by the temporary insolvency administrator - is the first party. Within the framework of the classic self-administration, the old company is often represented by an external lawyer, an insolvency administrator, or a lawyer specialized in insolvency law. In this case, the administrator acts as a controlling body in the proceedings. On the other hand, investor groups are represented which are mainly divided into two parties: Strategic investors on the one hand and financial investors on the other.

What are the characteristics that are important for the individual stakeholders to ensure that a transaction process runs smoothly?

The most important thing is to develop a common willingness to successfully "close" a transaction. From the point of view of the seller - and from the point of view of the creditors - it is of course a purchase price optimization. On the other hand, it should also be the common goal - especially in today's world - to save as many jobs as possible.

This includes finding an investor who is trusted to be able to develop the company successfully stand out in the future. Take for example the German rim manufacturer BBS. It entered insolvency for the third time. The same applies to the Schweizer Group, an automotive supplier. As well as other well-known companies in which the investors sometimes do not manage to lead the acquired company into a successful future after the insolvency. Instead, there are subsequent insolvencies, which we refer to as serial insolvencies. In order to avoid this, all involved parties must have a common goal in mind and also make the right choices in terms of the financial institutions that have financed the company in the past and also the lessors and credit insurers. The company and the new investor must continue to be supported.

What are the best skills and qualities that distress M&A advisors like yourself bring to the table?

You have to know your trade: The preparation of a sales exposé (information memorandum) and the clean drafting of the entire process is concentrated hard work. However, the continuation concept, which the M&A consultant develops together with the insolvency administrator and the company management, is also very important. M&A consultants must also see themselves as mediators standing between sellers and potential buyers. Empathy, communicative skills, a very stringent and sustainable negotiation process, and the establishment of a trusting basis play an incredibly important role here. It is essential to bring together the different interests of the parties. This requires a sharp instinct to be able to smooth out any ripples that may arise during the course of a process.

How do you achieve the best level of cooperation with insolvency administrators?

At enomyc, we have the advantage that we - beyond the classic distressed M&A - develop concepts for continuation of the company and prepare the necessary liquidity plans for the insolvency administrators. We also provide interim management to stabilize the companies during the insolvency, as well as provide support in operations. In the past eight years, we have succeeded in establishing a very trustworthy relationship in the industry. Today, we can claim that we have a business relationship with almost every successful insolvency administrator in Germany.

How crucial is a large, resilient network in the sales process?

The size of the network is not of the utmost importance, the resilience of that network, however, is. When you work together with potential investors on a long-term basis, whom you meet again and again in many cases, it is absolutely essential that you operate in a fair, open, honest and stringent manner when interacting with your partners. Demonstrating these qualities and establishing a track-record serve to build-up a high level of confidence and are a must when you are under time pressure. The reliability that all information is correct is an absolute success factor.

What difficulties lurk within the distressed M&A process and how can they best be avoided?

A major issue is the speed usually involved in distressed M&A. The time window to lead the potential buyer to a closing is small and often the buyer does not feel this time pressure. However, in the context of insolvency proceedings, as consultants we feel this pressure very clearly. It is helpful if the potential buyer himself mandates qualified advisors or law firms with sufficient insolvency experience for the process. In my experience, almost no deal is handled purely with in-flight funds. A further challenge is the diversity of cultures that potentially collide during the transaction. Particularly with foreign investors, tact and experience are among the key factors that are beneficial.

What do you personally find attractive about distressed M&A?

I am attracted by the speed involved and the wide variety of business models that can be dealt with in a very short time. The projects alone this year spanned across the world's largest steamship fleet, automotive suppliers, projects in the hotel industry, bakeries, internationally positioned shoe and locksmith services, as well as many others. I find it exciting and fun to familiarize myself with new subjects on short notice. I have found this to be essential for being able to screen the market and to deal with the different industries in the best possible way.

Which processes bring you the greatest pleasure?

I think all consultants share the great joy when the sale of the company is successful, and most of the jobs were able to be secured. The gratitude, which is then partly expressed by the workforce, is a highlight every time. The lows are, on the other hand, procedures in which the companies could not be sold, must be liquidated and many people lose their jobs. Joy and sorrow are often times very close together in this business.

You have established and further developed distressed M&A at enomyc. Why did you see the business area as a supplement to the classic restructuring?

Because I believe the range of services for a company in crisis - i.e. in insolvency - should not be limited. Today, we go far beyond pure distressed M&A and also offer established restructuring approaches in post-insolvency situations, providing companies with the support that is needed. Our clients and partners thus benefit from a broad range of mandates and a network of more than one hundred consultants with a high impact.

How do you estimate the impact of COVID-19: Does the pandemic have an impact on the probability of success in distressed M&A and will there be a shift in industry focus?

I assume that the number of insolvencies will continue to increase significantly in the coming months. In my view, the probability of success in selling a company out of insolvency will unfortunately be lower. Successful completion rates and transaction volumes are also likely to decline significantly. As far as industry focus is concerned: Corona has an impact on all industries. The focus is certainly on the tourism sector or the automotive industry with its large network of suppliers. However, it will also be tight for those companies that have missed out on digitization, especially for those operating with stationary retail.

What is the situation with the investor groups? Are new ones being created as a response of the pandemic?

In our core business, it is clear that it will remain with the established players - whether financial or strategic investors. I suspect, however, that some groups of investors pursuing a buy-and-build strategy will reposition themselves and try to seize any opportunity to acquire companies at relatively low cost, dock to an existing organization and draw possible synergies from it. Here, every investor should analyze the business model of the company: Without a viable business model, even a low purchase price makes no sense. If the strategic approach is not sufficiently developed, the only result will most likely be another insolvency.

Does it make sense to invest right now?

Yes, now makes sense to implement the business model of the competitors who are leaving the market into one's own while also updating it. In this way, one's own business can be strengthened with a certain company size, while retaining the know-how of the workforce and the experience of the management.

Which final thought would you like to share?

I would like to express my gratitude! To all our partners for the trust they have placed in us, for the many years of cooperation, for the fact that we have stuck together even in difficult times and for maintaining an open feedback culture. In this way, we have jointly succeeded in constantly improving the quality of our services.