The M&A analysis has been carried out, and the due diligence process is completed. How can companies achieve sustainable integration success? “With the right integration strategy,” says Florian Tretau, director at enomyc. Experience shows, however, that many companies lack a strategy or underestimate the duration and effort of the integration process and start too late in the integration process. What is the basis of a successful integration strategy, and which individual levels must be mastered?

TIME FOR A COMMON STRATEGY

The foundation stone for a sustainable integration success – and thus for a successful M&A transaction – is a clearly defined strategy. This should be formulated jointly in the early phase of integration. If an attempt is made to define an integration strategy and planning only during the implementation phase – especially after closing– unnecessary complexity occurs in the integration process, which often manifests itself in acute subproblems. Thus, companies often risk overloading the organization when running parallel projects. In order to manage the merger of two companies on a good financial, strategic, and operational level, it is essential to start early and to establish a separate organization project.

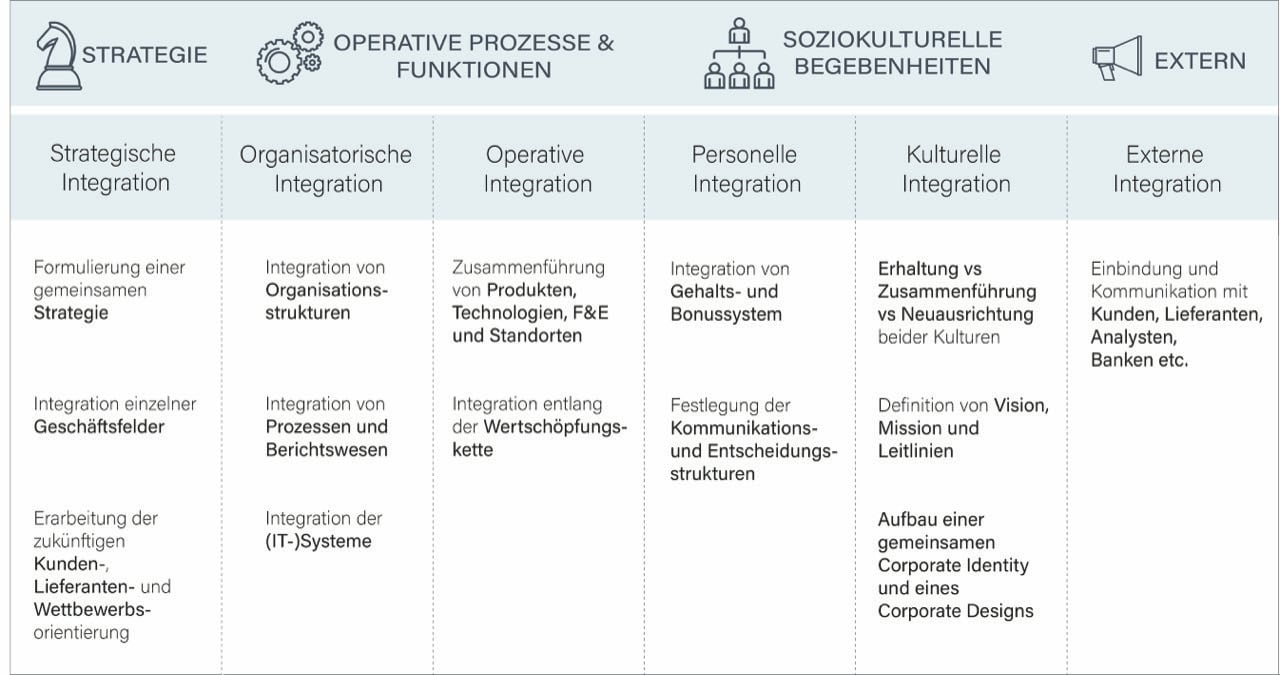

THE INDIVIDUAL LEVELS OF INTEGRATION

Depending on the acquiring company and acquired company, the degree of integration can vary greatly – from complete integration in very similar business areas and overlapping customer bases all the way to the intentional maintenance of the organization and, if necessary, the market presence of the acquired company.

In any case, companies should consider and manage all stages of integration.

THE STRATEGIC INTEGRATION

THE STRATEGIC INTEGRATION

What is the purpose of the merger from a long-term perspective? Which strategic objectives are to be achieved? How similar should or must companies be to implement these strategic goals?

Should branches be merged, production lines integrated, and salary systems coordinated? Or should the companies continue to exist individually or only be merged partially – for example, in sales?

The extent of integration between the organizations involved is mainly determined by the strategic decisions of the management regarding the direction of growth and the future position of the new company.

As regards timing, the strategy that a buyer had before the transaction must be adjusted at the latest by the time the new entity joins.

ORGANIZATIONAL INTEGRATION

At the operational level, the subdivisions are to be changed or adjusted in order to be able to realize corresponding synergies. In the case of horizontal mergers, a high degree of integration is obvious. But it is not only the financial level and the strategic orientation that need to be coordinated here; the operational level also could be in need of adaptation or even require the complete reengineering of individual workflow processes.

It is crucial to achieve clearly defined processes. All areas of the value chain must function smoothly and as quickly as possible – as must the infrastructure required for this, like the IT systems, for example. Experience has shown that integrated IT is first and foremost a cost driver; however, it is also a key success factor in the implementation of mergers and acquisitions. In any case, it must be ensured that all IT resources and infrastructures are recognizable and that there is a strategy in place that combines the two forms of IT environment.

OPERATIONAL INTEGRATION

It is precisely the horizontal form of the merger that is often practiced with the aim of creating cost synergies, economies of scale, and/or economies of scope. Branches need to be merged, administrative departments centralized, distribution channels streamlined, personnel reduced, and more so that material and organizational resources such as shared warehouses and distribution systems can be used cooperatively.

In the first step, the “quick wins” should be identified – namely, the immediate synergies that can be quickly realized without large consolidation measures. If possible, these should be lifted immediately in the first postmerger phase. Further revenue synergies resulting from access to new markets, a larger customer base, or the use of cross-selling opportunities can often only be realized in the later phases of integration. This is one of the reasons why it is advisable to use organizational and operational integration to identify a timeline for action. However, it makes sense not to be too optimistic in terms of expectations or to expect a conservative approach.

The closure of sites, for example, is quickly calculated as a possible synergy – at least in theory. Whether this can be implemented so quickly is another matter. Experience shows that cost synergies cannot be realized so swiftly. On the other hand, the integration of products and product portfolios should be implemented rapidly. Finally, a new product or service portfolio should be presented to the customer in a timely manner and consist of the existing and newly added products or services.

The foundation for sustainable integration success – and thus a successful M&A transaction – is laid down in the early phase of the integration. With the above recommendations for structured processes in strategic, organizational, and operational integration, you too can achieve sustainable integration success. However, a sustainable integration strategy can only be completed by the addition of personnel and cultural integration as well as the external integration of customers, business partners, banks, and more. We will also be reporting on this shortly.

Which topics around M&A processes are you currently dealing with? Are you interested in thinking them through together with us? We look forward to hearing from you.