The mighty Association of German Industry (BDI) recently said the country’s "export-oriented economy must prepare itself for difficult times” in the wake of the coronavirus crisis. In view of such gloomy forecasts, it’s always heartening to hear about companies that are flourishing in the crisis and making use of unexpected opportunities – serving customers that had been out of touch for a long time in considerable volumes. These companies should now strengthen these rekindled customer relationships with some new sales power.

German medium-sized companies in the floor coverings industry, for example, suddenly found themselves back in the game in recent months. Their Italian, Spanish and Chinese competitors in the ceramic floor coverings market were having a hard time supplying their customers. As their supply chains weakened or gave way completely, customers looked for alternative suppliers and often found them in Germany. After the initial massive shocks of the coronavirus crisis, many businesses did see some surprisingly positive developments.

Suppliers that had not done business with a client for long time were suddenly being asked to make up for the deliveries canceled by competitors. That means plenty of companies will have to ask themselves the following questions once the crisis is over: Can additional revenues created by the crisis be nurtured to become sustainable and stable customer relationships? What lessons should a company derive from this for its sales strategy? In the course of our projects, we find that most companies know their markets well, even very well. But sadly only a few of them have a binding and operationalized sales strategy.

This surprising omission is often the result of a lack of tools and willingness – especially in sales departments. But once the crisis is over, many companies would be well advised to define a formal sales strategy. Luckily, this task can be accomplished in about six weeks with with a clear and simple procedure. Companies should develop sales strategies for individual products/product groups, services or solutions. Companies that approach this exercise in the right way will be able to answer these six key questions very clearly and concisely.

1. What is the relevant market for a specific product or service and how will it develop?Even though most companies know their markets well, we often find that they have almost no market analyses to consult. Companies do not follow and evaluate their markets and their sub-segments with any regularity. The plastics processing industry, for example, can be divided into markets for different applications – cables, containers and so on. To develop a sales strategy, the first step is to work out the shape and trajectory of each segment and to identify trends and, if necessary, new sales channels (e-commerce/digital platforms).

2. What market share and sale capacities do other market participants have?The competitive environment is a strategically crucial factor. Companies need to know their main competitors’ share of any given segment and their strategic approaches – for example, with regard to renewing or expanding their offerings. In our experience, competitors are usually evaluated very broadly. But it is crucial for companies to look closely at competitors’ strengths and weaknesses to better understand their own competitive position.

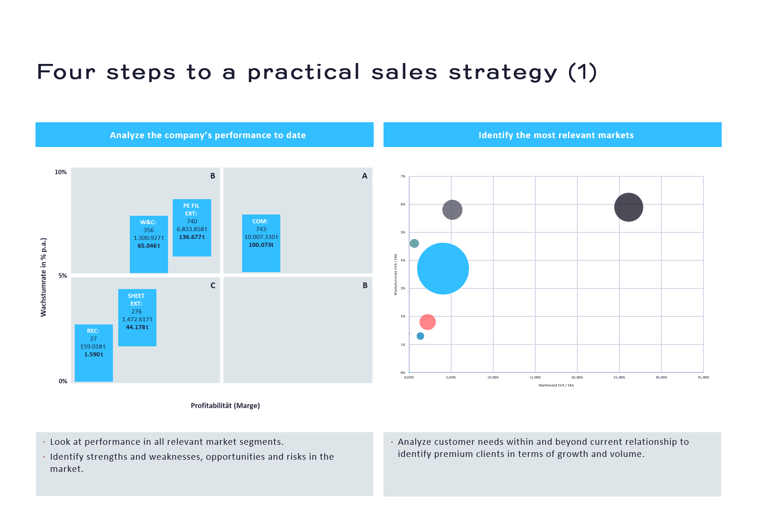

3. How is the company itself performing in these particular market segments?

Companies should not only know how markets and other players are developing, but also how their own performance fits into the picture. This comparison often reveals a first set of priorities that demand action – maybe, for example, because high-margin segments are found to be underrepresented or because high-volume customers are served exclusively by competitors. This exercise allows companies to clearly assess and identify which segments their sales departments need to prioritize to boost growth and profitability going forward.

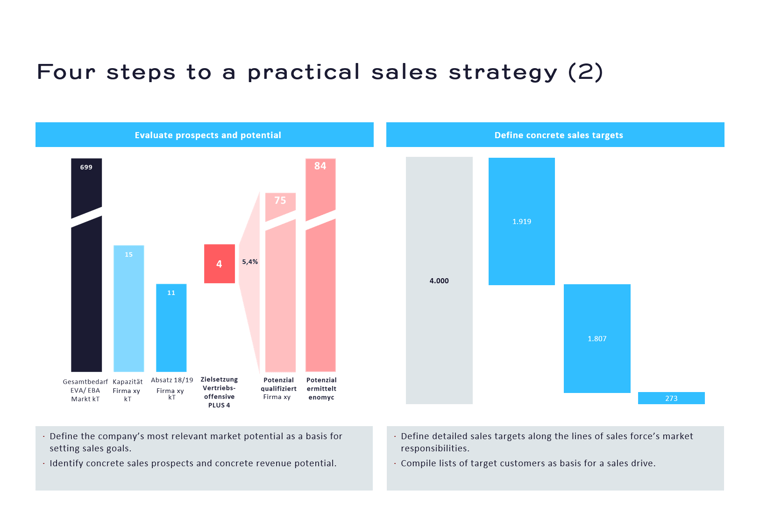

4. What (additional) potential do relevant market segments have?

Companies can only manage what they measure. A good sales strategy always requires a clearly quantifiable objective to mark progress towards sales targets. Market volume and growth are good examples of the kind of factors targets should monitor. But the real challenge is to measure more abstract market potential and use this data for targets.

5. What customers can this potential be realized with?

Companies can use internal and external data in a targeted way to break market potential down onto the level of individual customers. This overview of customers and contact persons to target is the actualized market potential of the company. This kind of data is an excellent foundation for everyday sales routines – and for targeted sales drives.

6. What targets can be derived from these customers and how quickly can they be reached?

Customers should be assigned according to existing sales responsibilities – for example, divided up by country or regional markets. The company sets each sales employee concrete targets for each individual customer that should be precisely controlled and monitored. Targets can even be linked to specific customer meetings, allowing sales potential and its possible realization to be closely planned and controlled by the executives in charge.

Companies will have to resort to data-based sales management techniques to answer all six questions. They will have to evaluate internal and external data, which could for some be a first foray into data-driven sales, the basis of modern data-supported sales management. Before the crisis, we often dealt with companies whose day-to-day operations were marked more by operational improvisation than any more conceptual market approaches. Crises are always good for a change of course as companies can use their cover to realign themselves and adopt sales strategies that are internally accepted, implementable and practical.

Contact us to receive an bespoke offer for your company.