The fate of our global supply chains has even occupied the tabloid press in recent weeks. As the coronavirus spread, it worried about empty supermarkets shelves, idle car factories, an entire economy on the verge of ruin. When an issue makes the leap from consultants’ presentations to, say, Germany’s Bild newspaper, the situation must be dramatic. But we shouldn’t tumble headlong into doing something – anything – to put things straight. The crisis has created different supply-chain problems for different industries, so we need different and sector-specific solutions.

1. Review supply-chain strategy

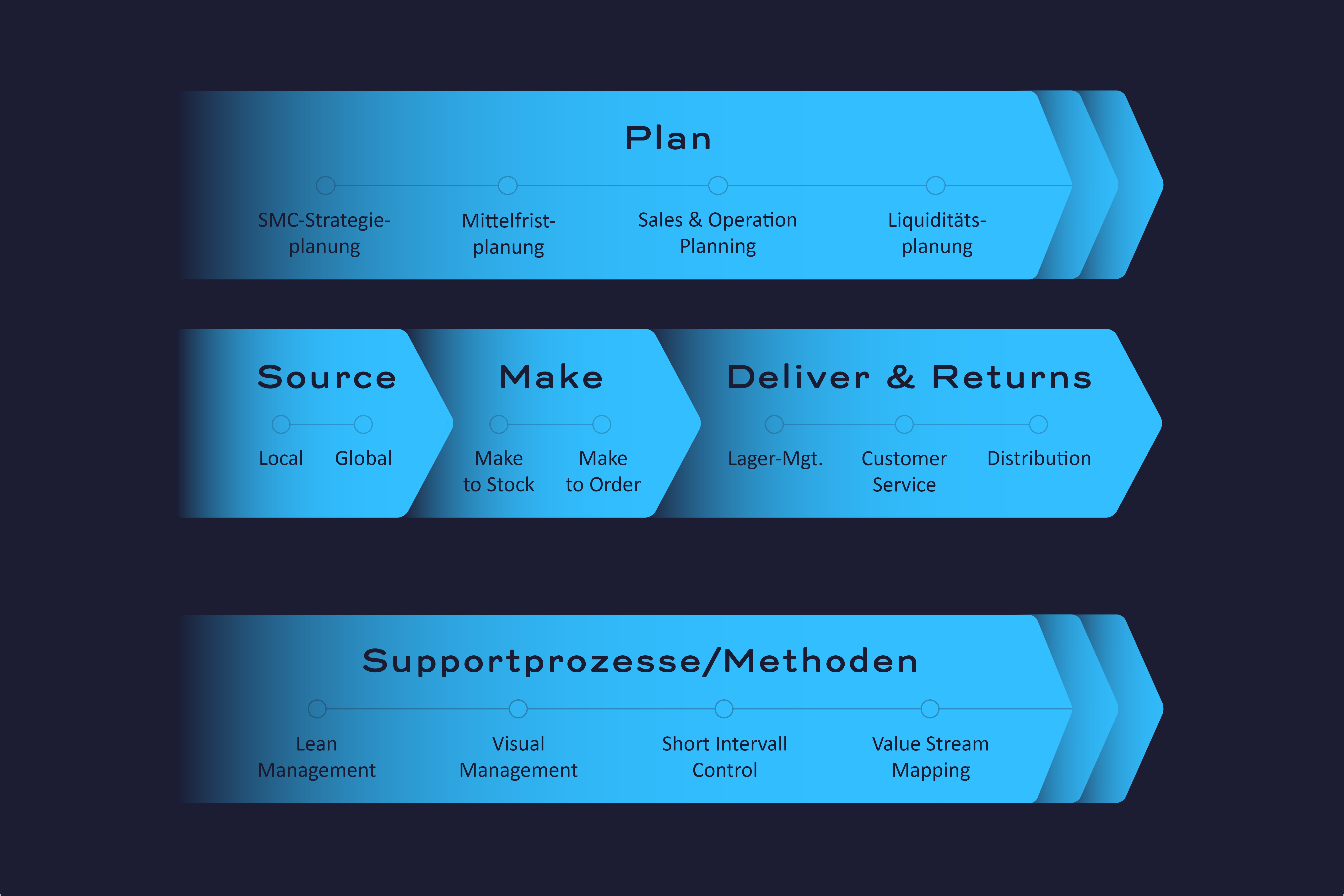

Companies need to get a picture of the changes underway in global procurement, production and markets – and possibly adapt their strategy accordingly. They must review and, if necessary, adjust or redefine their supply-chain strategy. The goal is to secure the supply of materials, safeguard operational flexibility and minimize business risks.

2. Make planning more agile

In the consumer goods sector, we are currently working on a project with an SAP service provider to optimize the consistency of a client’s planning processes. In many companies, planning is still too complex and slow, when it should be efficient, flexible and consistent. Sales & operations planning, for example, has to dovetail with other departments’ plans. To ensure this, coordination and communication has to involve all relevant business areas. Transparent value creation is a prerequisite for integrated supply chain management

3. Manage liquidity rigorously

Cash is the name of the game. Liquidity will be crucial for companies for the foreseeable future. Declining revenues, efficiency losses, rising procurement prices, deterioration in working capital, added crisis-management costs will pose enormous challenges for companies (no matter what government aid programs governments may have been launched – not every company will find itself declared systemically relevant like Lufthansa). From now on, companies need to update their liquidity planning at least once a week

4. Coordinate with customers and suppliers

Companies are currently managing on an ad hoc basis and are will continue to do so for quite a while. Extended planning horizons from pre-crisis days are now inadequate – cycles are becoming ever shorter. This means sales teams must get even closer to the customer to communicate their plans at shorter intervals and with higher accuracy. Companies have to ensure that customers, all relevant corporate departments and stakeholders communicate properly – also and especially along the entire supply chain back to the supplier.

5. Secure critical supply chains

Supplier management has recently seen the failures of the past take revenge. When a supplier failed, a positive year-old supplier evaluation was of little use. Construction and agricultural machinery makers, for example, often have very specific supply-chain needs. Aside from personnel issues, procurement is currently their top priority. They have to define what the need, their suppliers, alternative sources – and ensure that all the parts are available. All companies have to reassess their supply chains. They all need to bear in mind that global supply chains mean more goods in transit and thus require more working capital. In the past decades, companies switched from sourcing close-by to global sourcing for cost reasons. After the pandemic, regional and local sourcing is set to make a real comeback.

6. Improve production management

Companies have to integrate production management into the overarching planning, communication and management processes more firmly than before the crisis. They will also have to adapt key performance indicators (KPIs) and steering concepts. In highly interlinked and highly automated manufacturing like automotive or electronics, production is usually guided by efficiency parameters like plant utilization. Companies should now, at least temporarily, prioritize planning quality, flexibility and delivery reliability as crucial KPIs.

7. Improve processing times

The continuous improvement of production processes and throughput times often gets forgotten in the cut and thrust of everyday business – and all the more so in times of crisis. Nevertheless, companies that want to optimize their long-term value creation must strenuously pursue goals like reducing loss times, complying with planning specifications and hitting target costs. This is the only way they can cut production costs and throughput times in order to more quickly serve their markets or profit from the exit of competitors. This is particularly true for very complex sectors like plant engineering and shipbuilding.

8. Refine KPIs

Established key performance indicators (KPIs) used to steer a company will have to be adjusted. The crisis means traditional targets like shorter cash conversion cycles over the medium term will be impossible to hit. Instead, companies together with customers and suppliers will have to redefine payment targets for accounts payable and receivable to adapt cash conversion to the company's health. Companies must also reconfigure inventories to ensure long-term supply security in the face of market fluctuations and supplier failures.

9. Drive digitalization

A renewed digitalization push in supply chain will open new opportunities for the company as well as its suppliers, customers and other partners. Manufacturers of heating, ventilation and air-conditioning systems and mechanical-engineering companies, for example, have set up in-house digitalization teams. Potential applications are shown in the diagram. Demand planning, for example, uses big-data analysis to predict demand; warehousing optimizes inventories with real-time monitoring and automated order/delivery; production pushed to next-stage digitalization uses a new era of control devices to optimize equipment.

10. Carry out a vital quick check

10. Carry out a vital quick check

Companies are faced with the fundamental question of how to proceed after the crisis. Ideally, they can now take steps neglected in the past and gain competitive advantage. The prerequisite for this is learning lessons from the crisis that will strengthen supply chains. We offer companies a compact Supply Chain Assessment that gives them an objective evaluation of strengths and weaknesses, sets benchmarks and identifies areas for improvement.

Contact us to receive an bespoke offer for your company.