In the wake of the Corona restrictions, many companies have had to contend with falling sales while costs remained the same. As a result, their liquidity began to dry up and some even faced insolvency. At the latest in such a situation, liquidity planning is recommended. But there are many stumbling blocks.

While long-term sales planning has long been standard practice in most companies, planning liquidity development often leads a shadowy existence. There is often uncertainty about the right approach. If the planning is then prepared under great time pressure, the error rate increases.

Basics of liquidity planning

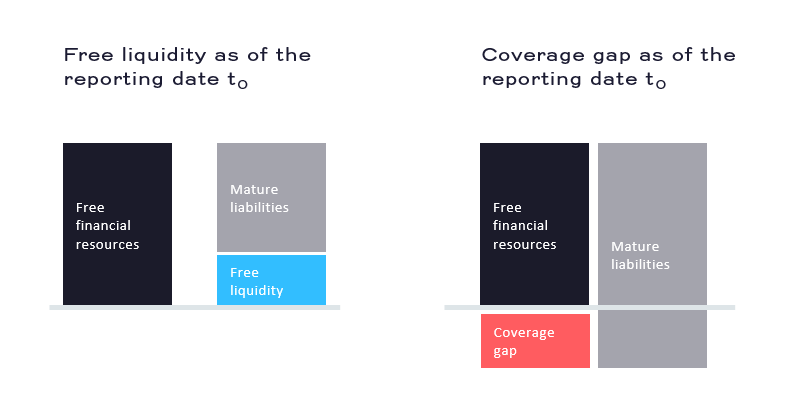

Professionally prepared liquidity planning shows the company's governing bodies, on the one hand, that the company is solvent in the legal sense and that there is no obligation to file for insolvency. On the other hand, planning enables targeted corporate management. Liquidity planning therefore consists of two elements: the liquidity status and the actual liquidity planning, which should be prepared on a weekly basis. In this context, the liquidity status serves as the starting point for liquidity planning by comparing the liquid funds (bank and cash balances minus the utilization of the current account line plus the available current account line) with all the liabilities due on the selected reporting date. The difference between these two figures corresponds to the free liquidity.

Liquiditätsstatus zum Stichtag t0

Liquiditätsstatus zum Stichtag t0

Weekly incoming and outgoing payments are planned, based on the liquidity status. For this purpose, the receivables and payables resulting from the open item list are taken into account in the liquidity planning according to their due date. In addition, payments received from long-term customer contracts, the order backlog and planned sales must be taken into account. Disbursements based on the purchase order commitment, continuing obligations (such as rents) and planned disbursements for goods not yet included in the purchase order commitment and personnel must also be included. The sum of these cash inflows and outflows results in the company's planned operating cash flow, which should be presented separately. In the long term, the operating cash flow should roughly correspond to the planned EBITDA.

The total cash flow is calculated from the additional consideration of existing and new financing (in particular interest and repayments) and the planned investments. The cash and cash equivalents or free liquidity at the end of each week is derived from the closing balance of the same in the previous period and the total cash flow in the same period.

What to look out for: the five most common mistakes

When calculating the above values, errors and inaccuracies occur time and again, because unfortunately, the pitfalls of everyday life play only a minor role in studies and textbooks. Here is an overview of the most common errors in practice and tips on how to avoid them:

1. Incorrect structure

Adherence to the correct structure - consisting of liquidity status and liquidity planning with the described superordinate categories - is the linchpin of clean liquidity planning. In everyday business, however, the liquidity status is often included implicitly, but mistakenly in liquidity planning. As a result, the liquidity development in the planning period is correctly mapped in terms of content, but an exact check on the existence of reasons for filing insolvency is not possible on this basis, as this is initially based on the free liquidity in a key date analysis analogous to the liquidity status. Adherence to the structure described, the calculation logic, the superordinate categories of inflow and outflow and the terminology used improve the comprehensibility of liquidity planning all signal your expertise and planning competence to financing banks in particular.2. Incomplete presentation

Another point that urgently needs to be taken into account is that liquidity planning must always include all types of incoming and outgoing payments in full. In particular, payments for interest and redemption as well as planned investments and individual permanent debt relationships are often not taken into account in practice. Taking into account items for which no cash inflow or outflow is included in the planning gives all the parties involved the great feeling of having "thought of everything"..3. Incorrect raw data

Liquidity planning is only as good as the data used for planning. Open item lists in particular often contain old cases that have not yet been cleared up or incorrect payment targets. I often happens that existing receivables and payables have not all been accounted for, or down payments received or made have not been mapped correctly. This is why it makes sense to check the open item lists carefully in advance and to correct them if necessary. To ensure that the open item list is as up-to-date and correct as possible, it is advisable to have a fixed process agreed with the accounting department so that the open item list is at the current posting status on a certain key date.4. Incorrect payment dates

On the incoming payments side, the open item list does include due dates, but the actual payment date can deviate considerably from this, for example due to customers using cash discounts or chronic late payers. These circumstances should be taken into account by means of a safety margin in terms of value or by postponing the time of receipt of payment. Liabilities should always be planned strictly according to actual due dates.5. Lack of plausibility

Liquidity planning must be based on comprehensible and conservative planning assumptions. For plausibility checks, historical incoming and outgoing payments and reasonable material, personnel and usage rates can be applied. In order to ensure that all links in liquidity planning are correct, we recommend the installation of check lines in addition to the dual control principle. With their help, you can check whether all planned incoming and outgoing payments have really been fully taken into account.Massive effort is needed. But what is the use of liquidity planning?

The initial preparation of a liquidity plan is undoubtedly associated with a great deal of effort. Nevertheless, it is far more than a necessary evil that is only carried out for liability reasons. High-quality liquidity planning offers both the visionary entrepreneur and the cautious businessman an optimal overview of the development of liquidity and thus serves as a powerful planning and control instrument.

Above all, the preparation of a liquidity plan usually brings to light undreamt-of potential. For example, reviewing and correcting open item lists provides a good basis for negotiating payment terms and bonus agreements with suppliers and customers. This often results in valuable approaches for improving accounts receivable and accounts payable management. The dependency on individual debtors and creditors can also be reduced in the course of such a comprehensive review based on sound data.

In addition, a review of continuing debt relationships provides a good opportunity to question the necessity and benefit of many products and services purchased in the past. This can help contain the steady growth of overhead costs. In terms of processes, the implementation of liquidity planning also opens up great potential for improvement in many companies, for example because purchase order commitments are scrutinized.

If you follow the most important basic rules, you will quickly discover that revolving liquidity planning can be implemented in a time-saving manner and will pay off in the end. In our next blog post on this topic, we will turn our attention to the supreme discipline: the dovetailing of direct liquidity planning and integrated financial planning. Because by implementing these two planning approaches, planning errors in the sensitive area of liquidity can be identified and corrected.

What liquidity planning questions are you concerned about? We support you with individualized planning tools and effective implementation assistance. Please do not hesitate to contact us. We look forward to hearing from you!

.jpeg?width=900&height=650&name=photoeditorsdk-export%20(7).jpeg)